State Approves Dealer Education Law

April 19, 2024Years of work have culminated with a dealer education program being signed into law in Indiana.

The requirement for applicants to complete a training course through the Indiana Independent Automobile Dealers Association before receiving a used motor vehicle dealer license begins July 1.

“It’s a big win for the association,” said Alex Downard, IIADA Executive Director. “We’ve not had any education in place to get a license. Our board fully supported this.”

The IIADA will be working with the Indiana Secretary of State to finalize the program which must provide information on licensing requirements, laws and rules.

The online course, which will also include best practices, will be $300 paid to the IIADA. Only new dealers will be required to take the course.

Downard praised the work of the staff to get the bill passed. He also thanked NIADA for its support, including CEO Jeff Martin meeting with the Secretary of State in the fall after the BHPH Dealer Forum in Indianapolis.

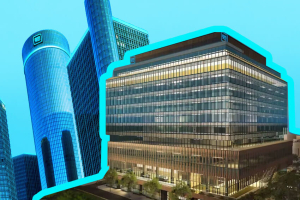

GM to Relocate HQ in 2025

April 17, 2024General Motors will relocate its global headquarters to Hudson’s Detroit in 2025, becoming the anchor tenant at Bedrock’s development on the historic site of the former J.L. Hudson Department Store. This marks GM’s fourth headquarters location in the city since 1911, reaffirming its longstanding commitment to Detroit. GM, Bedrock, the city of Detroit and Wayne County will establish a partnership to explore redevelopment opportunities for the Renaissance Center site over approximately the next year, prior to GM’s move to Hudson’s Detroit.

“We are proud to remain in the city of Detroit in a modern office building that fits the evolving needs of our workforce, right in the heart of downtown,” said GM Chair and CEO Mary Barra. “Our new headquarters will provide collaboration areas for our teams, executive offices and display space for our vehicles. Dan Gilbert and Bedrock have done so much to make downtown Detroit a great place to live, work and visit. We are thrilled to be a significant part of the historic Hudson’s project and also look forward to working with them to explore new ideas and opportunities for the Renaissance Center site and the riverfront.”

The move to Hudson’s Detroit will mark GM’s return to Woodward Avenue, where it established its first headquarters in the city. GM has now entered into an initial 15-year, multi-level lease for the top office floors of the state-of-the-art office building as well as showcase space on the street level for GM vehicles and community activations.

Group 1 Adds 54 UK Dealerships

April 16, 2024Group 1 Automotive, an automotive retailer with 202 dealerships in the U.S. and U.K., has entered into a definitive agreement to acquire the U.K. automotive retailing business and related owned real estate from a subsidiary of Inchcape plc for approximately $439 million (£346 million) in an all-cash transaction, inclusive of $279 million (£220 million) of appraised real estate value. In 2023, the Inchcape U.K. dealerships generated approximately $2.7 billion USD (£2.1 billion) in annual revenues. The transaction is subject to the receipt of approval from the Financial Conduct Authority and is expected to close in the third quarter of 2024.

“Group 1 has successfully operated in the U.K. since 2007 and we are extremely pleased to have this opportunity to grow in this important market,” Group 1’s President and Chief Executive Officer Daryl Kenningham said. “Inchcape’s brand mix is outstanding. These new stores complement our geographic footprint in the East and South East of England and enable us to expand into new markets in the Central and North West regions of England and Wales.”

With 54 dealership locations across major hubs in England and Wales, Inchcape’s U.K. dealership portfolio includes Audi, BMW/MINI, Jaguar Land Rover, Lexus, Mercedes-Benz/smart, Porsche, Toyota, Volkswagen and Volkswagen Commercial Vehicles. On an aggregate basis, these dealerships sell over 63,500 new and used vehicles, and 24,000 corporate units, annually.

CarMax Net Revenues Dip

April 13, 2024CarMax Inc. reported results for the fourth quarter and fiscal year ended Feb. 29. Highlights for Q4 include net revenues of $5.6 billion, down 1.7% compared with the prior year fourth quarter.

Retail used unit sales increased 1.3% and comparable store used unit sales increased 0.1% from the prior year’s fourth quarter; wholesale units declined 4.0% from the prior year’s fourth quarter.

The company delivered solid margins in retail and wholesale; gross profit per retail used unit of $2,251 and gross profit per wholesale unit of $1,120, both down slightly from last year’s historically strong fourth quarter. The company bought 234,000 vehicles from consumers and dealers, down 10.8% versus last year’s fourth quarter, which benefited from strong appreciation.

CarMax Auto Finance income of $147.3 million, grew 18.9% from the prior year fourth quarter due to a lower provision for loan losses, reflecting tightened lending standards, and an increase in average managed receivables, partially offset by compression in the net interest margin percentage (NIM). NIM of 5.9% was consistent with this year’s third quarter.

“We are encouraged by the performance of our business during the fourth quarter,” said Bill Nash, president and chief executive officer. “We reported growth in total used unit sales and comps, delivered strong retail and wholesale gross profit per unit, continued to actively manage SG&A and grew CAF income significantly year-over-year.

Holman Acquires Auto Group

April 13, 2024Holman, a global automotive services leader, has completed its acquisition of the North Carolina-based Leith Automotive Group. This nearly doubles Holman’s automotive retail business, which now features 58 dealerships, 34 brands, and almost 4,500 retail automotive employees in nine states; and marks the largest retail acquisition in Holman’s 100-year history.

This expansion of Holman’s retail portfolio includes 13 new franchises and its first auction center. All Leith facilities are located in the greater Raleigh area and Aberdeen, N.C.

“In our centennial year, we’re excited about the opportunities to strengthen and grow our automotive retail footprint that began in 1924 with a single dealership,” said Chris Conroy, Holman CEO. “This acquisition represents the culmination of extensive strategy, hard work and vision to put our employee partners and our business in a position to win for the next 100 years,”

Both family-owned organizations have a legacy of success and growth. Together, Holman and Leith remain committed to doing the right thing for their employees, customers and the community. The deal preserves the Leith brand and team.