Delinquencies Climb in Auto Finance

April 11, 2024A dip in subprime lending and delinquencies continued to climb according to the Experian State of Automotive Finance Market released earlier this year. The report, covering Q4 2023 also showed that the average LTV (loan-to-value) slid year-over-year for both used and new. The percentage of used vehicles financed dipped year over year to under 38% from more than 41%.

Under the Experian report, more than 33% of used loans were for buy-here, pay-here and “other” – the biggest share of used financing. More than 27% of used loans came from finance companies and nearly 23% of used loans were from credit union sources, Just under 16% of used loans came from traditional banks. Looking at used loans by state, Wyoming had the largest percentage of used vehicle loans at 83.7%, while New York had the smallest percentage of used vehicle loans 63.1%.

Subprime and deep subprime loans made up less than 22% of all used loans compared to 43% of prime and more than 14% super prime. The average used amount financed in 2023 fell to $26,685 over $1,200 less than the prior year. The average interest rates have continued to rise for used vehicle loans over the past three years. In 2021, the average loan rate was 8.2% and then jumped to 10.36%, while nearly hitting 12% in 2023. The average used monthly payment hit $532 in 2023, only a couple of of dollars higher than the prior year. The average used loan term actually fell slightly in 2023 to 67.4 months, from 67.4 in 2022.

The Experian report showed that used vehicle loan amounts financed fell across all loan risk segments with prime hitting $28,074 while subprime fell under $30,000. Prime saw the biggest dip in used loan amount – $1,479. The average used monthly payment by risk segment was $548 in the subprime category – the highest mount – to $526 for prime loans. Delinquencies continued to climb with 2.31% of auto loans 30-days delinquent and nearly 1% delinquent 60 days.

Average LTVs for used vehicles fell to 118.71% in Q4 from over 123% the prior year. Subprime and deep subprime loans saw higher loan terms at 66.25 months for subprime and 63.07 for deep subprime. Those risk segments also saw higher loan rates, with nearly 19% for subprime loans and over 21$ for deep subprime loans.

Overall loan balances (in billions) grew 4% year over year with biggest growth in the super prime and subprime segments.

On the new-car side, captives’ share of loans continued to climb to more than 61% while credit unions’ share fell to 12% and bank loans made up more than 20% of new-car loan market share. SUVs and wagons made up nearly 63% of new-financing by segment, followed by sedans at 16.58% and pickups at 15.19%.

Electric vehicles (EVs) made up 8.55% of new retail by fuel type, compared to nearly 76% for gasoline and just under 10% for gasoline/hybrid vehicles. More than 30% of EVZs being financed weer4e by lease. Nearly 49% were purchased through traditional loans.

U.S. Auto Sales Up In Q1 As Dealer Inventory Rises

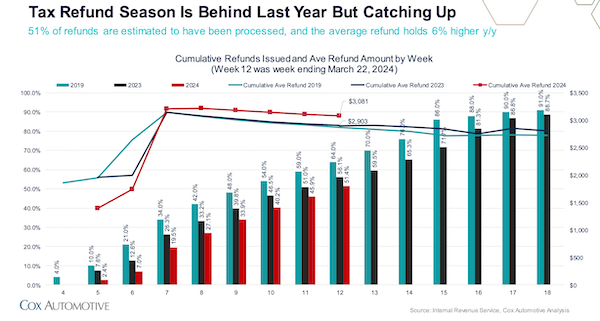

April 05, 2024Despite high interest rates auto buyers are still motivated and buying, though auto experts caution the industry may have already hit its spring/tax-rebate sales peak.

U.S. Automakers sold 3.8 million vehicles in Q1, a 5% increase in new vehicle sales over last year’s January to March numbers. Four factors are having an impact, dealer inventory reaching pre-pandemic levels across most of the country, auto manufacturers lowering prices, makers and dealers increasing incentives at the POS, and tax rebates.

According to J.D power March’s average sales price were down 3.6 % year over year to $44,186, the largest recorded drop for the month of March, since new vehicle sales reached a peak of nearly $50,000 in December 2022. The March seasonally adjusted annual rate is expected to finish near 15.5 million, up 0.6% over last year, but down slightly from February’s 15.8 million. J.D. Power expected leases to account for almost 25% retail sales in March, up from 19.6% in March of last year.

The average Used vehicle price fell to $27,297 in March, down 3.3% from a year ago and 12% from the peak of $31,095 in April 2022. Though prices still hover around 32% above the pre-pandemic used car average.

Cox Automotive Chief Economist Jonathan Smoke cautioned it appears the industry has already hit its spring sales peak as buyers expect the Federal Reserve to cut interest rates later in the year. “Interest rates are still near 24-year highs, and consumers just don’t have the urgency to buy, with the expectation that rates will be lower later this year,” he wrote in a market report. Auto interest rates are averaging around 7 % for New and 14% for used , after climbing from a low of 4.4% for new loans in November 2021 and 8.5% in January 2021 for used vehicle loan rates.

Dealer lot supply continues to grow. U.S car dealers in January of 2024 had 2.61 million new cars, trucks and SUVs on their lots, up from 1.74 million the previous year. In March, total supply of available new vehicles was up more than 50% from last year, according to vAuto data. "At the beginning of March, available dealer advertised inventories were up to 2.62 million units, an increase of 56% over last year and up 5% compared to the beginning of February 2023. Model-year (MY) 2024 vehicles represented 84% of that inventory, so pockets of MY2023 vehicles remain, setting up the potential for additional spring clearance activity." Matt Trommer, associate director of Market Reporting at S&P Global Mobility said.

Many automakers reported strong year-over-year sales increases in Q1, including Ford, Toyota, Honda and Rivian, while others like General Motors, Stellantis, Kia and Tesla reported declines. GM reported a 1.5% drop in Q1 sales, Stellantis a sales drop of 10%, while Kia sales dropped 2.5 %.

As EV sales growth continued to slow in Q1, hybrid sales have been climbing. Experts say the majority of early adopters have made the switch from ICE to BEV, with mainstream buyers still put off by high prices, range anxiety and charging station infrastructure worries. This seems to be leading to an increased interest in hybrid vehicles, once thought to be a non sequitur for EV adoption.

Sales of electric vehicles grew only 2.7 % to just over 268,000 during the quarter, taking 7.1% of market share, down from 7.6 % in Q1 of 2023. Tesla led the slump with a 9% drop in global sales. The EV automaker’s U.S. sales fell more than 13 % , according to Motorintelligence.com. On Tuesday April 2, Tesla posted a decline in quarterly deliveries for the first time in nearly four years, the company blamed the decline on factory upgrades, shipping delays, and power outages in its German factory. Following the announcement Tesla shares fell 5.2 % to $166.08 , losing around $30 billion in market value. The company's shares have fallen about 33 % in Q1.

Ford’s U.S. sales grew 6.8% in Q1 with a mixed powertrain portfolio, the Detroit News reported on April 3. The automaker had its best Hybrid sales quarter ever. Hybrid sales were up 42% to a record 28,421 sales. That's expected to grow with increased shipment of the F-150 hybrid model. EV sales were up 86% in Q1 comprising 4% of Ford’s mix, with Mustang Mach-E SUV sales up 77% , even after losing the EV tax rebate qualification.

Toyota reported a 20% increase in sales in Q1, with combined sales of its hybrids and EV’s rising 36%. Honda said its sales increased 17%, while Nissan and Subaru both posted 7% increases. Hyundai reported an increase of 0.2 %.

Automakers offered more incentives to attract buyers in Q1, then at any point during the past two years. U.S carmakers spent 5.9% of the average transaction price on incentives (an average of $2,787 per unit) in March, according to Kelley Blue Book data. In comparison, pre-pandemic incentives hovered around 20% of the average transaction price.

The luxury car segment offered the biggest incentives through much of last year. Luxury brand incentives topped 6%. in February.

Automakers offered the most incentives for electric cars, jumping 3-fold over the past year. "What we anticipate is that there will be significantly more discounting, more incentives," said Michelle Krebs, executive analyst for Cox Automotive. "We’re already seeing that."

Associations File Briefs Against FTC Rule

April 04, 2024NIADA and Texas IADA have joined the effort to stop the Federal Trade Commission from enforcing the vehicle shopping rule.

NIADA and TIADA filed an amicus brief to the NADA and Texas ADA lawsuit in the Fifth Circuit of the U.S. Court of Appeals, asking for the rule to be vacated. After the NADA and TADA petitioned the court, the FTC issued a temporary stay, holding off enforcement of the rule until the court provides a ruling.

“Every NIADA member works to promote a transparent and good experience for their customers,” said John Fullo, executive director of the TIADA. “The CARS Rule states these same goals, but in reality, it is overly burdensome and just results in more paperwork for the consumer and dealer thereby making the already paper-filled process to purchase a vehicle more time-consuming. We appreciate the opportunity to work with NIADA and support the Texas Automobile Dealers Association in their endeavor to overturn the CARS Rule.”

The recent filing by the NIADA and TIADA points to the harmful impacts on dealerships and consumers if the rule is put in place.

Consumers will see vehicle price increases due to the increased dealer requirements for disclosures and recordkeeping. They will also be faced with a more time-consuming and confusing sales experience, as dealers maneuver the disclosures, including providing an offering price and monthly payments in any discussion of a vehicle.

Consumers, who already have limited options, may find it impossible to secure financing as banks and third-party creditors reduce the funding to dealers lacking the resources to meet the requirements of the rule.

NIADA dealer members, more than 80 percent who employ less than 10 employees, will be faced with considerable costs from the rule, including professional fees from attorneys and IT personnel and record-keeping storage. Dealers may also see a decline in sales due to the extended sales process with the added disclosures and the repeating of the underwriting procedure for every vehicle inquiry.

The increased time spent covering the many disclosure requirements could also limit the amount of customers sales personnel may serve, impacting compensation and the overall performance of the dealership.

The rule’s impact could lead to the closure of many small dealerships due to loss of revenue and credit tightening. The loss of potentially thousands of dealerships will create ripple effects throughout the economy and in communities of all sizes.

“NIADA’s goal was to explain to the court the significant impact the rule would have on independent dealers,” said NIADA CEO Jeff Martin. “We did that by interviewing BHPH and retail dealers of various sizes and geographic locations to give a true representation of the industry. We appreciated the opportunity to collaborate with TIADA and were happy to support TADA and NADA. We will be offering more updates during our convention in June.”

Trucking Group Criticizes EPA Rule

April 01, 2024The American Trucking Associations said new emission standards for heavy-duty trucks that were announced last week by the U.S. Environmental Protection Agency have unachievable targets and will carry real consequences for the U.S. supply chain and movement of freight throughout the economy.

“ATA opposes this rule in its current form because the post-2030 targets remain entirely unachievable given the current state of zero-emission technology, the lack of charging infrastructure and restrictions on the power grid,” said ATA President and CEO Chris Spear. “Given the wide range of operations required of our industry to keep the economy running, a successful emission regulation must be technology neutral and cannot be one-size-fits-all. Any regulation that fails to account for the operational realities of trucking will set the industry and America’s supply chain up for failure.”

The EPA announced a final rule, “Greenhouse Gas Emissions Standards for Heavy-Duty Vehicles – Phase 3,” that sets stronger standards to reduce greenhouse gas emissions from heavy-duty (HD) vehicles beginning in model year 2027. The new standards will be applicable to HD vocational vehicles (such as delivery trucks, refuse haulers, public utility trucks, transit, shuttle, school buses, etc.) and tractors (such as day cabs and sleeper cabs on tractor-trailer trucks).

While EPA’s final rule includes lower zero-emission vehicle rates for model years 2027-2029, ATA stated forced zero-emission vehicle penetration rates in the later years will drive only battery-electric and hydrogen investment, limiting fleets’ choices with early-stage technology that is still unproven.

“The trucking industry is fully committed to the road to zero emissions, but the path to get there must be paved with commonsense,” Spear said. “While we are disappointed with today’s rule, we will continue to work with EPA to address its shortcomings and advance emission-reduction targets and timelines that are both realistic and durable.”

A recent study commissioned by the Clean Freight Coalition highlighted the significant infrastructure investment needs to electrify the nation’s medium- and heavy-duty vehicle fleet, and a recent report from the American Transportation Research Institute identified the many challenges facing commercial-vehicle electrification in the areas of U.S. electricity supply and demand, electric vehicle production and truck charging requirements.

U.S. Senators File Recall Legislation

March 28, 2024Three U.S. senators filed a bill that would require car dealers to repair any outstanding safety recall on used cars before selling, leasing or loaning them to customers.

Richard Blumenthal (D-CT), Edward Markey (D-MA) and Elizabeth Warren (D-MA) filed the bill.

“Whether a car is brand new or used, nobody should be at risk of purchasing an unsafe car,” Markey said in a press release. “And it doesn’t matter if a car is still on the lot or in a driveway, it needs to be made safe.”

The bill specifically addresses safety recalls. According to Blumenthal’s press release on the bill, manufacturers will be required to provide dealers with parts to make the necessary repairs within 60 days or reimburse the dealers.

The bill does provide exceptions, including recall information not being available at the time of the sale, vehicles being sold at wholesale and vehicles being sold as junk.

According to a National Highway Traffic Safety Administration report issued earlier this month, the agency issued 1,000 recalls for vehicles, car seats, tires, RVs and other equipment in 2023. Nearly 35 million vehicles were recalled in 2023.